Contract of Insurance:

A contract of insurance is a contract of utmost good faith technically known as uberrima fides. The doctrine of disclosing all material facts is embodied in this important principle, which applies to all forms of insurance.

At the time of taking a policy, the Insurer should ensure that all questions in the proposal form are correctly answered. Any misrepresentation, non-disclosure or fraud in any document leading to the acceptance of the risk would render the insurance contract null and void.

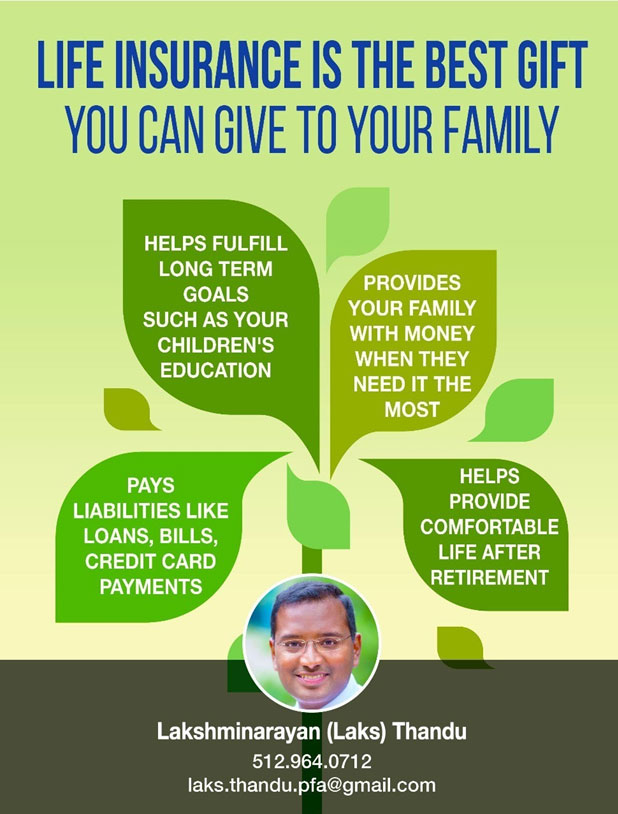

Protection:

Savings through life insurance guarantee full protection against risk of death of the saver. Also, in case of demise, life insurance assures payment of the entire amount assured (with bonuses wherever applicable) whereas in other savings schemes, only the amount saved (with interest) is payable.

Aid to Thrift:

Life insurance encourages 'thrift'. It allows long-term savings since payments can be made effortlessly because of the 'easy installment' facility built into the scheme. (Premium payment for insurance is either monthly, quarterly, Semi Annually or Annually).

Liquidity:

In case of insurance, it is easy to acquire loans on the sole security of any policy that has acquired loan value. Besides, a life insurance policy is also generally accepted as security, even for a commercial loan.

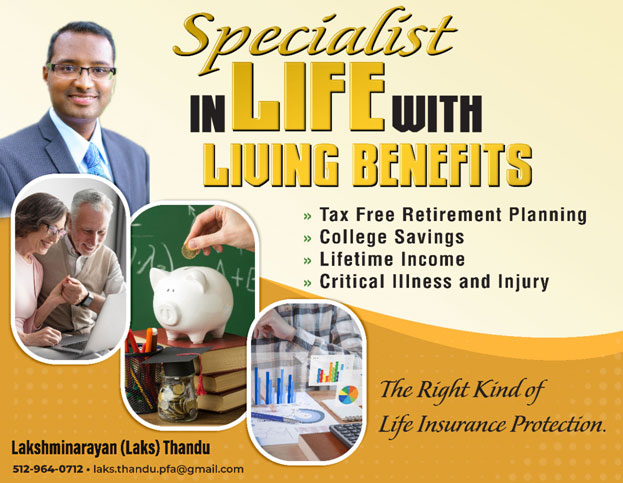

Money When You Need It:

A policy that has a suitable insurance plan or a combination of different plans can be effectively used to meet certain monetary needs that may arise from time-to-time.

College education, start-in-life or marriage provision or even periodical needs for cash over a stretch of time can be less stressful with the help of these policies.

Alternatively, policy money can be made available at the time of one's retirement from service and used for any specific purpose, such as, purchase of a house or for other investments. Also, loans are granted to policyholders for house building or for purchase of flats (subject to certain conditions).

Who Can Buy A Policy?

Any person who is eligible to enter into a valid contract can insure himself/herself and those in whom he/she has insurable interest.

Policies can also be taken, subject to certain conditions, on the life of one's spouse or children. While underwriting proposals, certain factors such as the insurer state of health, the proponent's income and other relevant factors are considered by the Carrier. There are few carriers been extending insurance coverage without any medical examination, subject to certain conditions.